This is one of the least covered topics, yet absolutely crucial. The banks are warming the planet and continue to do so without ever being held accountable.

The 13th edition of the Banking on Climate Chaos report has just been published and the figures are, as every year, staggering. Just one is enough to understand the scale of the disaster: French banks allocated more than $350 billion to fossil fuels between 2016 and 2021, including $130 billion to the 100 companies developing the most new fossil fuel projects. All this after the Paris Agreement. This is a scandal, and the word is certainly an understatement.

Everyone needs to take ownership of the figures in this report. Both climate activists and anyone with a bank account. The banks’ activities have a dramatic impact on the climate, biodiversity, but also on many countries and peoples who suffer directly and indirectly from their activities.

Foreword: background and perspective

Before going into the details of the figures and orders of magnitude, there are at least 3 important elements to know.

Firstly, the International Energy Agency (IEA) stated in 2021 that “the goal of zero net emissions by 2050 – to which 44 of the 60 banks covered by this report have committed – requires “no new oil and gas fields“. None means NONE. Yet we will find that banks around the world have been massively supporting the companies that are doing the most to open up new oil and gas fields.

Secondly, as highlighted by Welsby et al. To maintain a 50% chance of reaching a temperature of +1.5°C, 90% of known coal and 60% of known oil and gas must remain in the ground. To achieve carbon neutrality by 2050, there are no 150 solutions: end our dependence on fossil fuels.

Third and last, this report emphasises our dependence on fossil fuels, for which the banks have a direct responsibility. This dependence is not only responsible for climate change (IPCC reports), but also indirectly for wars like the recent one in Ukraine. Experience shows that despite the fanfare of carbon neutrality in 2050 announced in 2021, business as usual (and therefore climate inaction) has almost systematically been preferred to compliance with the Paris Agreement.

One thing is now certain: any bank that supports a company that develops fossil fuels is causing climate chaos.

How to read this report?

This report presents commercial and investment bank financing for the fossil fuel industry, and analyses the world’s 60 largest relevant banks by assets. It aggregates their main roles in lending and debt underwriting and equity issuance.

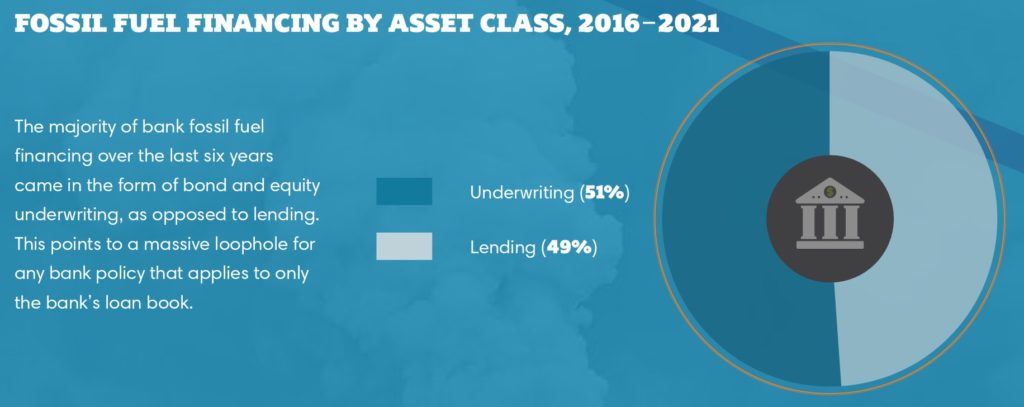

The majority of bank financing for fossil fuels has been in the form of bond and equity underwriting, not loans. This points to a huge flaw in any banking policy that only applies to the bank’s loan portfolio. It should be remembered that their carbon neutrality commitments only cover the balance sheet as a whole, as their obligations are broader: adoption of decarbonisation targets and reduced exposure.

Source : Banking on Climate Chaos 2022

Concerning the scope, Approximately 2,700 subsidiaries of 1,635 parent companies are involved, each of which has received financing led by one of the 60 banks analysed and which are involved in the extraction, transportation, transmission, combustion, trading or storage of any fossil energy or fossil electricity.

Let’s move on to the amounts…

Criminal orders of magnitude

The figures that follow are so large that it is difficult to imagine what they represent. They will have to be systematically placed in front of each promise, each word of the “green”, “CSR”, “bank of a changing world” managers. Here are some shocking orders of magnitude from the report, not an exhaustive list:

- Fossil fuel financing by the world’s 60 largest banks reached $4,582 billion in the six years following the adoption of the Paris Agreement.

- In 2021 alone, $742 billion in fossil fuel financing.

- NO significant decrease in funding in 2021 compared to 2020, and given the projects and companies already funded, there is a risk that 2022 will not be a climate friendly year.

Source : Banking on Climate Chaos 2022

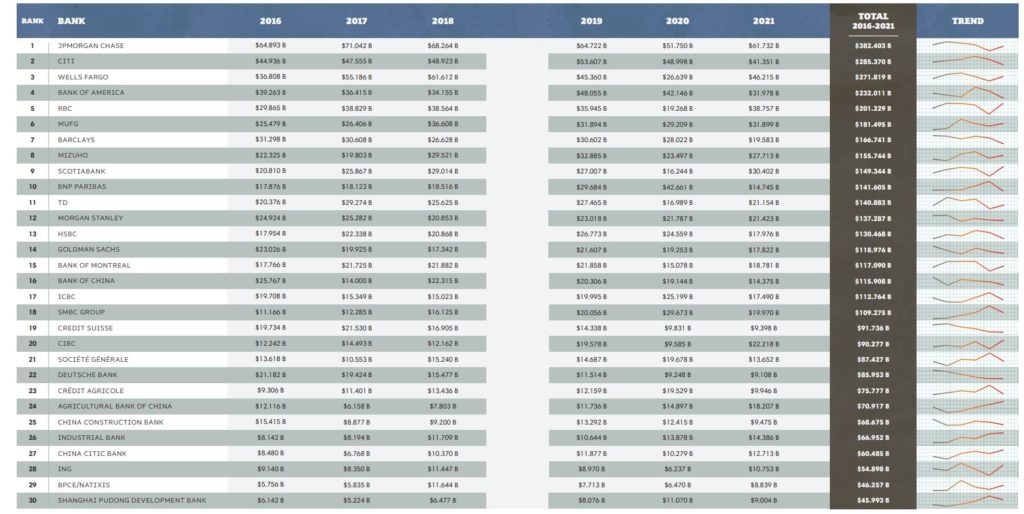

- US banks continue to be the worst, with the top four financiers in the world (JPMorgan Chase, Citi, Wells Fargo and Bank of America), followed by Morgan Stanley and Goldman Sachs in the top 14. These six banks provided 29% of the fossil fuel financing identified in 2021.

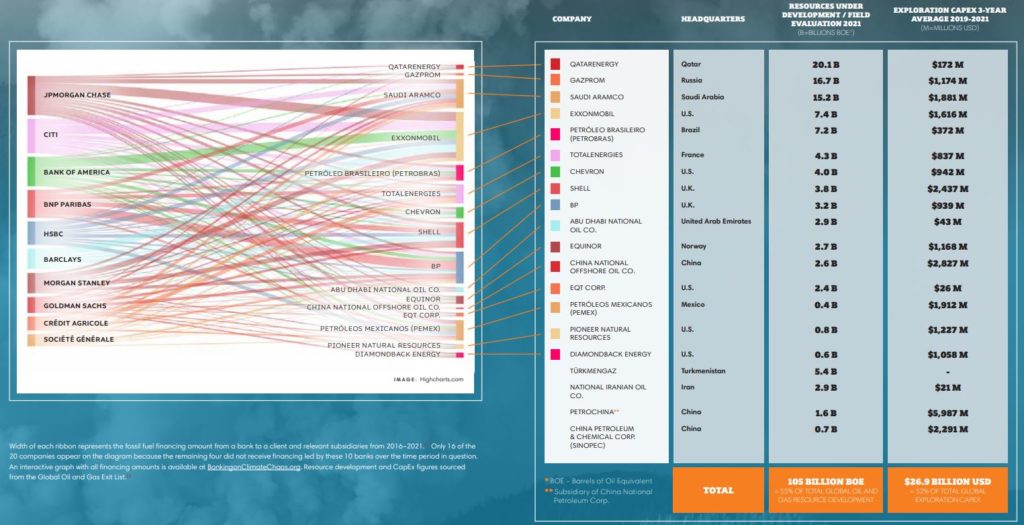

- Oil and gas expansion is remarkably concentrated: the top 20 companies are responsible for more than half of resource development and more than half of exploration capital expenditure.

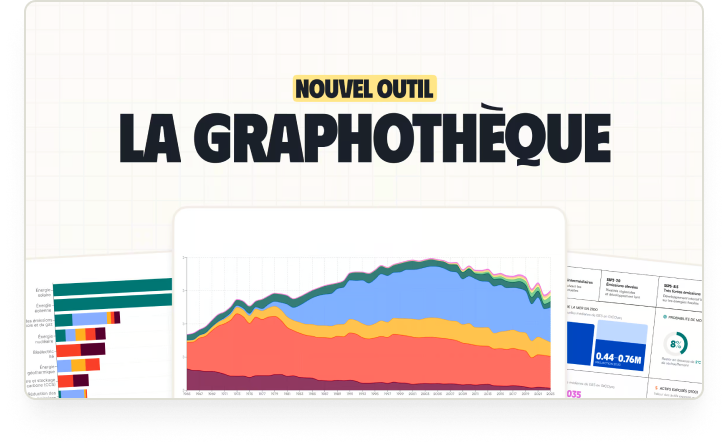

The ranking below lists the banks that have financed fossil fuels the most since 2016:

Ranking of banks that have financed fossil fuels the most

Source : Banking on Climate Chaos 2022

French banks, an international disgrace

Impossible is not French! Despite hundreds of scientific warnings about the deadly consequences of global warming, major French banks continue to play a key role in fossil fuel expansion. Since COP21 :

- They have provided $131 billion in financing to the top 100 companies developing new fossil fuel projects.

- They make France the third country to support the development of fossil fuels, behind the United States and China.

- Paris is the European Union’s leading supporter of the fossil fuel industry and is close behind London. 87% of this capital comes from just 3 banks: BNP Paribas, Société Générale and Crédit Agricole.

- Crédit Agricole is Gazprom’s 4th largest banker since 2018, and Total’s largest

Special mention goes to BNP Paribas, which has done us the honour of distinguishing itself. The bank is the 5th largest financier of fossil fuel development in the world, after 4 US banks. BRAVO ! Or rather not bravo, it is an international shame. Only Bruno Le Maire, Minister for the Economy, who was blocked in 1970, can be pleased with such a feat.

It should be noted that BNPP is even the leader in the Arctic, a region that is warming 3 to 4 times faster than the rest of the planet and whose evolution is of the utmost concern to climatologists. But what does the survival of a part of humanity represent compared to the profit and joy of the shareholders?

NEWSLETTER

Chaque vendredi, recevez un condensé de la semaine, des infographies, nos recos culturelles et des exclusivités.

+30 000 SONT DÉJÀ INSCRITS

Une alerte pour chaque article mis en ligne, et une lettre hebdo chaque vendredi, avec un condensé de la semaine, des infographies, nos recos culturelles et des exclusivités.

Banks, fossil fuels and wars

The Global Oil & Gas Exit shows that the development of the oil and gas industries is remarkably concentrated: the top 20 companies are responsible for more than half of the resources under development and spending on exploration for new reserves. Bank support for these companies is also remarkably concentrated: the top 10 bankers of these top 20 companies are responsible for 63% of the large bank financing of these companies.

The graph below is remarkable, and shows that the issue goes beyond the banks: it encompasses the entire global economic system. You will recognise the names of companies that finance dictatorships and sometimes wars on a daily basis, such as Russia, which invaded Ukraine over a month ago.

Click here for an interactive panel

TotalEnergies, Gazprom, Saudi Aramco, BP, ExxonMobil, Qatar Energy, PetroChina… all benevolent companies that are undoubtedly THE solution to global warming, according to their respective presidents who kept repeating it during COP26. A hypocrisy that has been highlighted more than once, without creating any real general indignation.

La Banque Postale, the only counter example?

According to the Oil and Gas Policy Tracker, no French bank has a robust exclusionary policy in place, significantly limiting support for major oil and gas expansion companies. Not only do the measures taken by the major French banks only cover certain parts of the oil and gas industry, but they have no impact on the sector’s majors, which are still planning massive investments in fossil fuels, including non-conventional ones.

None, except La Banque Postale. A few months ago, the bank announced an innovative policy that suspends support for all companies developing oil and gas, and commits the bank to moving away from oil and gas financing entirely by 2030. This is a strong commitment for a bank with assets of USD 901.7 billion. To be continued of course, promises are only binding on those who believe them.

To a lesser extent, banks such as Crédit Agricole and Nordea Bank have made similar commitments regarding coal. Crédit Mutuel has also adopted a policy of excluding coal mine, factory and infrastructure developers from financing, but has not yet fully blacklisted oil and gas expansion companies. This is of little consolation when one considers the orders of magnitude and the profits made by the 60 banks in this report.

Are there any solutions?

The report indicates 4 steps to be taken to keep a chance of meeting the Paris Agreement. These are mandatory if we want to limit warming to +1.5°C:

- Ban all financing for all fossil fuel expansion projects and for all companies that expand fossil fuel extraction and infrastructure along the value chain.

- Begin immediately to reduce all fossil fuel financing to zero, with an explicit timetable aligned with limiting global warming to 1.5°C, starting with coal mining and power, as well as funding for existing projects and companies involved in tar sands oil, Arctic oil and gas, offshore oil and gas, fracked oil and gas and LNG.

- Measure, set and publish targets for offsetting the absolute climate impact of all financing activities on a timetable aligned with 1.5°C, including short, medium and long term targets.

- Prohibit funding for projects and companies that violate human rights, including indigenous rights. Fully respect all human rights, in particular the rights of indigenous peoples, including their rights to water and land and the right to free, prior and informed consent, as set out in the UN Declaration on the Rights of Indigenous Peoples.

The solutions are obvious and have been known for decades. It is only a question of political will. Leaders who play the green job blackmail card are in fact playing the game of inaction and will probably no longer be in charge to face the consequences.

The last word

The leaders of the world’s banks have a duty to do more. To do better than promises they will never keep, or to gamble the future of the planet on technological promises in which they do not even invest significantly. The moral duty not to leave an uninhabitable Earth for part of humanity in the years to come. If most of the decision-makers will no longer be around to be judged, being able to retire in anything other than a 50-degree summer in France does not seem like the stupidest idea ever.

All citizens must take ownership of the orders of magnitude of bank financing to fossil fuels and hold the banks accountable, including the French banks that actively participate in global warming. Also, and consequently, anyone who relativises the need to cut fossil fuel financing is an enemy of the climate, and probably has an interest in playing the status quo.

The IPCC reminded us in its latest report that “any further delay in concerted and early global action on climate change adaptation and mitigation will miss a brief and rapidly closing opportunity to secure a liveable and sustainable future for all“.